Japan AGM megabanks and trading houses’ votes reveal big investors fail on climate risk

July 4, 2025

Market Forces

FoE Japan

Rainforest Action Network

Kiko Network

Japanese and international environmental groups are concerned that Japan’s largest banks, trading houses and Chubu as well as leading investors are failing to take climate risk seriously enough following results from annual general meetings this week.

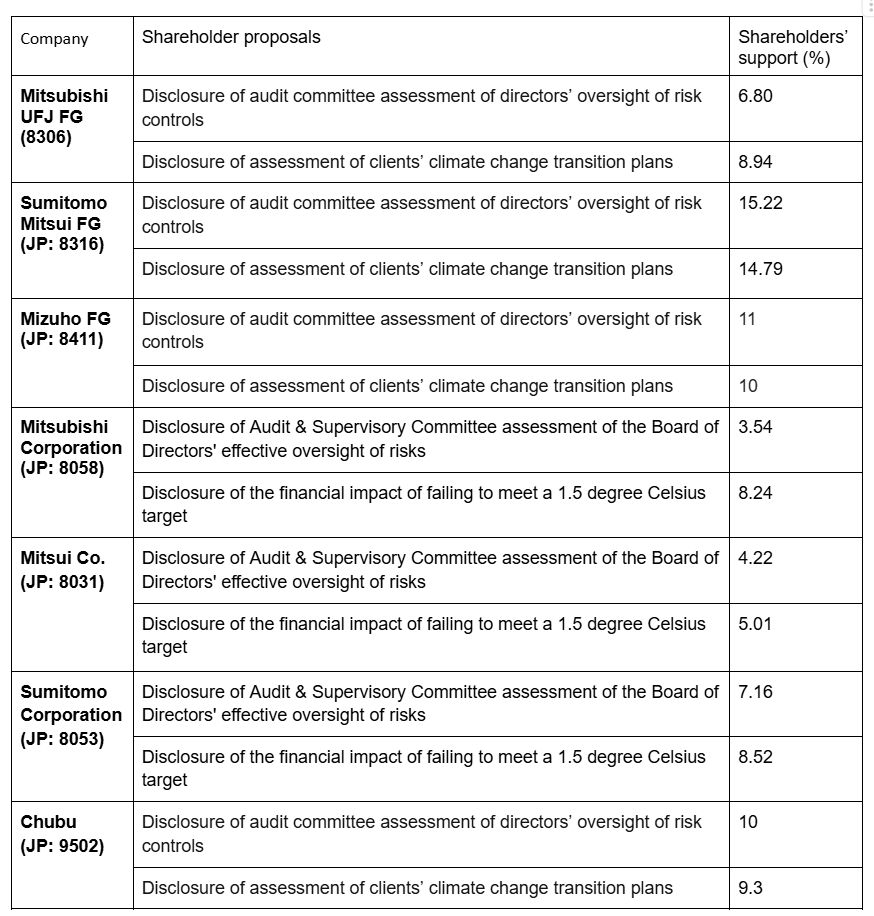

The environment groups filed shareholder proposals on climate change and governance to three Japanese megabanks (Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, and Mizuho Financial Group), trading houses (Mitsubishi Corporation, Mitsui & Co., and Sumitomo Corporation), and Chubu Electric Power Company. Despite having net-zero targets to achieve the 1.5°C target, these companies' operations are not aligned with this goal. Given the companies' continued involvement in fossil fuel investments and businesses, it is critical that Japan’s major banks and trading houses take decisive and substantive action to manage their climate risks.

The results of this year's resolutions indicate that many investors are not demanding sufficient accountability for climate risks from the companies in question. Similar proposals were filed to financial institutions last year, but Mizuho FG's approval rate is about half of last year's, with no substantive improvement seen. Investors have also failed to holdChubu Electric Power to account, with a reduced vote in favour of strengthened governance to manage climate risk compared to last year.

The proposals filed to the companies concerned and the voting results (some preliminary) are as follows. Some proposals showed a certain degree of support, with some receiving more than 10% support. However, some proposals received less than 10% support, which raises serious concerns about whether most asset management companies are adequately concerned about climate risk. Although all of the shareholder proposals were rejected, we will continue to urge companies subject to the proposals to strengthen their climate measures and will continue to engage institutional investors to embody their stewardship responsibilities.

However, we have witnessed that some institutional investors are backing demands for robust monitoring of how companies are strengthened by adequate governance and competent directors. In fact, one of the major proxy advisors, ISS, has released its recommendations for investors to vote against seven directors from one of the companies that faced shareholder proposals this year. Moreover, some investors agree with the need for strong oversight of the implementation of climate risk management by companies and call for stronger governance. Legal & General Investment Management (LGIM), the United Kingdom’s biggest asset manager and a major global investor across public and private markets, managing US$ 1,502 billion in assets, declared its support our shareholder proposals to Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group, Mizuho Financial Group, and Chubu Electric Power.

Mismanaged risks from climate change pose a significant danger to a company's value in the long term. The current business policies of three major Japanese trading houses, Mitsubishi Corporation, Mitsui & Co. and Sumitomo Corporation, are aligned with global heating of 2.6°C to 3.6°C, risking catastrophic climate change, which is inconsistent with limiting global warming to 1.5°C set in the Paris Agreement. Japanese 3 mega banks continue to finance companies expanding fossil fuel production and infrastructure which does not align with the 1.5°C goal. According to the Banking on Climate Chaos 2025 report, Mizuho increased its financing to fossil fuel expansion companies by 16% and MUFG increased by 3.6% in 2024.

We pursue notable changes and actions by leading Japanese companies to address climate risk. Over the last five years, we can reveal that some of Japan’s biggest banks and trading houses have been exercising their risk controls by withdrawing support for key fossil fuel projects in Asia as a result of our engagement, including highlighting concerns of local communities. For instance, we have confirmed that Mitsui & Co. has withdrawn from the CPGCBL LNG power plant project in Cox's Bazar, Bangladesh in 2023, and that would achieve avoidance of 44 million tons of CO₂ emissions over the project’s life cycle.

At the same time, we will implement further engagement with asset managers. Market Forces’ recent research, for instance, has revealed that Japan’s five biggest investors have failed to demonstrate the consequences of failing to align with net zero commitments, having voted in favour of Japanese Fossil Fuel companies’ directors 99% of the time to be re-elected.

Comments from Filers

Trading Houses and Chubu

“While the level of shareholder support was modest, the message remains clear: Japanese trading houses and Chubu Electric face material climate-related risks, and investors expect decisive action.

“We are still very much concerned about the lack of credible decarbonization business strategies and effective human rights consideration in business operations.

“Our aim remains focused on demanding that companies deliver credible decarbonization and a sincere response to human rights violations with effective risk management and transparent governance mechanisms.

“We will continue to engage these companies constructively, strengthening collaboration to enhance their transition away from fossil fuels globally.”

Kentaro Nunokawa, Japan Energy Campaigner, Market Forces

“At the AGM, Chubu Electric Power clearly stated coal-fired power as a “baseload power source” and repeated the necessity of stable energy supply. It also said that it will pursue any measures to achieve both stable power supply and decarbonization. However, that approach will leave a significant burden on future generations. As a power company that emits large amount of GHG, we urge the company to establish a feasible roadmap and strengthen measures to accelerate the transition from fossil fuels to renewable energy.”

Yasuko Suzuki, Program Coordinator, Kiko Network

“Mitsui & Co. has a large exposure to climate risk, and it is important that the company take effective and viable risk measures in the time remaining to address climate change. Enhanced information disclosure is the first step towards this.In particular, given the company's current strategy, which has a net-zero policy but is highly dependent on fossil fuel segments, this was a reasonable request. We would like to continue engaging with the company to strengthen its climate measures.”

Ayumi Fukakusa, Executive Director of FoE Japan

3 mega-banks

“Japan’s big banks have made little if any progress in managing climate risk over the past year, despite strong support from shareholders to our identical proposals on clients’ credible transition plans last year.

“Support for this year's shareholder proposals has declined, indicating many investors are failing in their corporate duties, undermining necessary oversight of climate change risk management at Japan’s biggest banks, trading houses and energy companies.

“The credibility of companies and investors is under growing scrutiny: they must demonstrate meaningful, science-based actions toward decarbonisation.

“The consequences of inaction are unacceptable for our economies and humanity. We cannot afford any delay in implementing effective action and speeding up the shift away from coal, oil and gas to reliable renewable energy.”

Eri Watanabe, Japan Banks Campaigner, Market Forces

We have made a new resolution related to disclosure of auditors’ accountability to each megabank. In addition, Mizuho and MUFG finance the Rio Grande LNG project in Texas, USA, which is opposed by local indigenous communities. It is a violation of the international standard they adopt, the Equator Principles. MUFG also finances a company that controls oil palm plantation companies which were sued by the Indonesian government for damages for large-scale peatland fires. These are just a few examples of their governance problems. The current situation where audits are not aware of governance issues within the company's own group is a sign that the internal audit system is not functioning. The weakness of the risk management systems of the megabanks is also evident in their continued investment and lending to companies that plan to expand fossil fuel businesses that are at risk of stranded assets, despite the bank's goal of achieving net zero by 2050. Additionally, there are concerns about institutional investors failing to see through these structural governance issues. We call on institutional investors to make truly responsible investments with a focus on long-term sustainability.

Toyoyuki Kawakami, Rainforest Action Network

“This time, we challenged a new proposal to ask for auditors’ accountability. At SMBC and Mizuho, the proposal requesting disclosure of information related to the audit committee’s financial risk audit received slightly higher than another proposal, while MUFG’s number of votes for both proposals was lower than the other two banks. Although the results vary, it indicates that a certain number of investors are seeking new initiatives. Three Japanese megabanks continue to provide financing to fossil fuel companies around the world, ranking among the top lenders globally. Shouldn’t we, as shareholders, speak out more strongly against the fact that banks, managing our savings, continue to finance fossil fuel-related businesses? Their activities are threatening the safety of our future lives, or in other words, contributing to the deprivation of the right to live in a comfortable environment. We also like to ask institutional investors to take a longer-term perspective and make responsible investments for the future.”

Yasuko Suzuki, Program Coordinator, Kiko Network

Contact for media

Market Forces

Antony Balmain E-mail: contact[@]marketforces.org.au

FoE Japan

Ayumi Fukakusa E-mail: info[@]foejapan.org

Kiko Network

Yasuko Suzuki E-mail: suzuki[@]kikonet.org

Rainforest Action Network

Yuki Sekimoto E-mail: yuki.sekimoto[@]ran.org